How to Simplify Office Management for Financial Services

If you’re an IT or facilities manager working in financial services, your top goals are easy to list, but can be much harder to achieve:

- Equipping your people and teams to do their best work in the office, with modern systems, platforms, and processes that support productivity and enhance employee experience.

- Retaining employees and customers, especially in uncertain market conditions. You simply must deliver good experiences to employees, customers, and in-office visitors.

- Maintaining and improving the security and confidentiality of client information within the strict regulatory landscape that financial services is known for.

- Getting the most return-on-investment from managing your office space and your technology infrastructure, two of your organization’s largest operating expenses.

- Planning strategic improvements and strategic expenditures informed by relevant workplace data so you can adapt to future business requirements.

Workplace Management for Financial Services: 4 Top Challenges

In the realm of financial services, the office plays an important role in day-to-day business. From client meetings to team brainstorms, it’s critical for organizations to have a well-managed workplace that can support these face-to-face interactions.

Here are some of the ongoing workplace challenges this industry is facing.

1. Hybrid Work Brings Inconsistent Schedules and Uncertain Office Utilization

You can’t be certain, on any given day, how many people are coming into your financial service organization’s work space, so you need to remain flexible with scheduling and how you utilize your available office space.

Amidst all this uncertainty, space booking software and effective meeting room management become especially important, as does effective visitor management (from both a space utilization and security POV, not to mention creating a good visitor experience). Optimizing your limited resources is job one.

2. Distributed Teams Mean More Hybrid Meetings

In a hybrid work setting, all organizations have to support people in the office to equitably collaborate with people working outside the office who connect digitally. The concept of collaborative equity means that all participants, in-person and remote, have equal and meaningful opportunities to participate.

The only way to create collaborative equity is to have the right technology in place that connects people and supports collaboration no matter where your financial services professionals are sitting.

3. Hybrid Work Complicates Data Security

Your employees work inside and outside the office, accessing and managing client information across multiple devices. That level of access to the financial and personal information of customers, combined with the industry’s stringent data privacy protections, makes your role in ensuring security and compliance even more complex.

Workplace technology can be a large part of the solution here, as we’ll discuss below.

4. The Need for Technology as an Enabler of Flexibility and Collaboration

You need to invest in the right technology tools to bridge the distance between physical and virtual spaces, so your people can collaborate equitably and be productive no matter where they sit.

Making the right investments in enabling technologies are an essential part of any workplace strategy, for every financial services organization.

5 Actionable Tips for Effective Office Management

Now that we know the challenges, it’s time to get into the solutions. Managing the workplace doesn’t have to be hard, especially when you have the right systems in place.

Here’s how to solve the challenges listed above:

1. Optimize Your Office Layout

Begin by taking an inventory of your office space, IT assets, hybrid work policies, and (most importantly) the current requirements of your people for office space.

You’ll need sufficient meeting spaces and desks to accommodate your people, but you may also need a variety of meeting spaces for: Zoom meetings, small team meetings, larger team meetings, all-hands meetings, as well as spaces for private phone calls, relaxation, and socializing over coffee/snacks.

Since the needs of your people for workspace will evolve, you must stay flexible with your office layouts too, using workspace utilization data to inform when and how you make adjustments.

2. Adopt Agile and Flexible Working Practices

Workplace flexibility goes far beyond office space to embrace policies and practices adopted by your financial services organization. You’ll need policies around hybrid work, defining the organization’s expectations, for instance, around how many days per week people should come into the office and how office space will be utilized (e.g., policies and processes around hot desking or hoteling).

Just as with the need for flexibility with office layouts, you’ll need to remain flexible with workplace policies and processes as people’s needs evolve.

3. Invest in Tools for Flexible Resource Bookings

How can you stay flexible while also supporting productivity and collaboration? It requires an investment in the right enablers, technology tools that flexibly support the use of office resources and people’s productivity, no matter where they work.

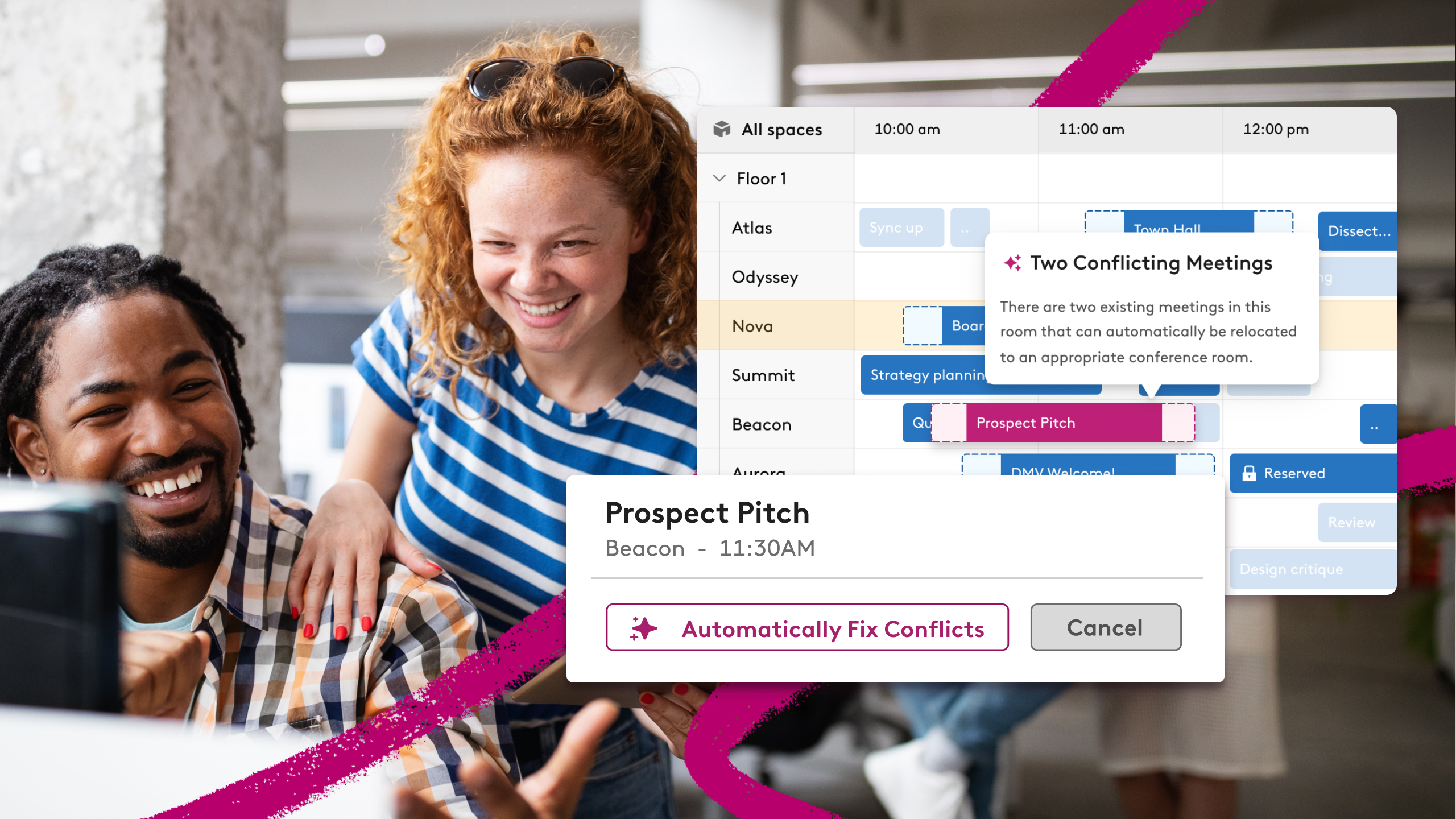

In the realm of supporting hybrid meetings, for instance, you’d need an effective meeting room booking system that displays your open inventory of available and appropriate rooms in real-time, allowing meeting organizers to seamlessly book the right room and communicate that booking to all participants.

Another essential investment is technology that enables people to collaborate, including videoconferencing technologies and equipment.

4. Be Clear with Communication

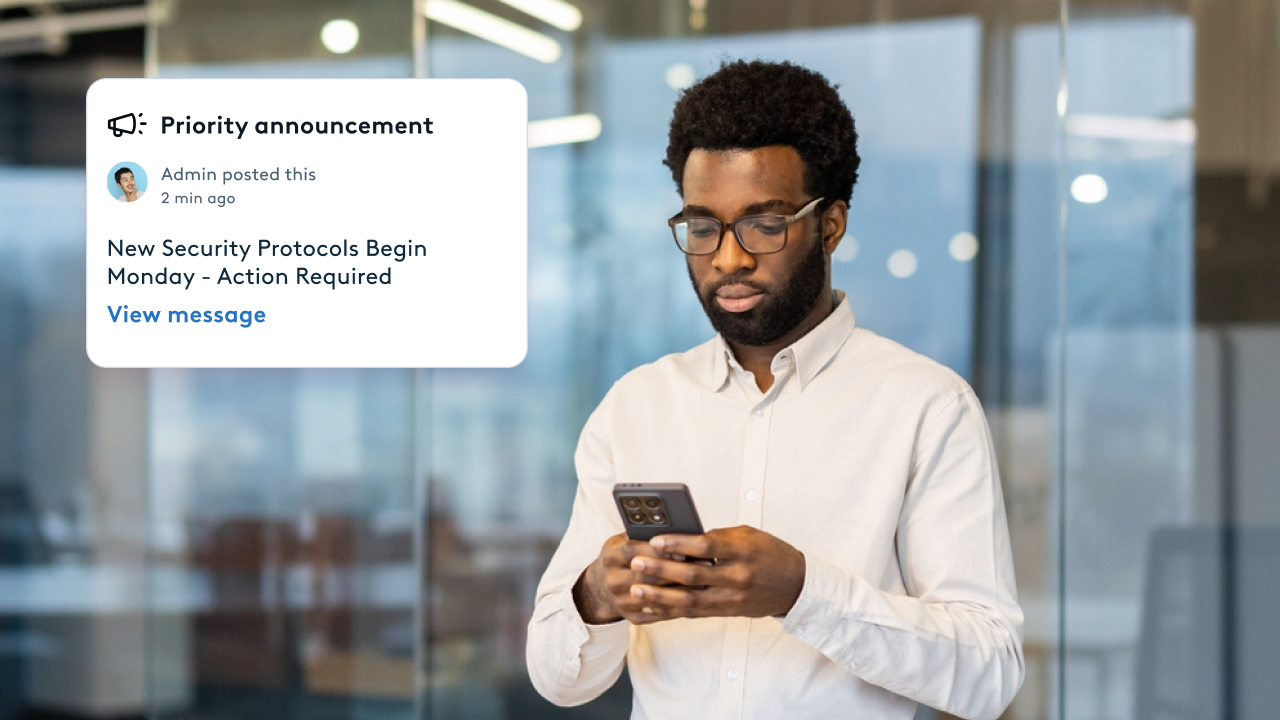

Even the most strategically-brilliant workplace policies and processes become meaningless unless employees actually adopt them. So beyond supporting and driving adoption with enabling technologies, organizations must back up everything they do with clear and consistent communication that brings people along.

Communication should be conducted across all relevant channels and should be two-way. When people are asked to provide feedback, the chances of organization-wide adoption/buy-in are increased. The opposite is also true, and we’ve seen some organizations trying “my-way-or-the-highway” workplace approaches that get undermined by employee pushback.

5. Evolve and Improve Your Workplace Solutions

At a time when flexibility is essential, no policy or approach is ever set-and-forget. You always need to monitor how your initiatives are performing against their key metrics, and then be ready to course correct based on incoming data/analytics.

For instance, if your office has two large conference rooms that are always booked, and eight mid-sized conference rooms, half of them woefully underutilized, you might consider converting the mid-sized spaces into larger conference rooms. Adjust, follow the data, and see what happens. That’s how data-informed improvements happen.

The Value of Better Workplace Experiences

There’s no doubt that the office will remain the preferred locus for workplace connection and collaboration in the financial services industry. People want it that way, even in (especially in) a time of hybrid work. But your role as an IT or Facilities manager is to find better ways to support people and stay flexible as you support people.

Once you’ve set up enabling workplace technologies that make people’s workplace experiences frictionless and even enjoyable, your financial service organization will reap the benefits:

(1) Your talent will stay and thrive under supportive conditions because they’re more productive and collaborative.

(2) You’ll see enhanced employee engagement will drive enhanced customer experiences and customer retention.

(3) You will experience more cost-effective and value-generating office utilization.

(4) You’ll have visibility into the performance of your workplace approaches and can continuously drive improvements based on data.

(5) You’ll be ready to thrive amidst uncertainty.

For more help in driving effective office management in your financial services organization, reach out to Robin.